Home

- Resources for Homeowners

Resources for Homeowners

Understanding your options may help you find the best solution to your housing needs. A housing counselor can assist, and staying up to date on current programs and issues may also be helpful. Below is a list of useful resources:

- 2-1-1– If you are at risk of foreclosure or are having difficulty paying your home mortgage, utilities, home insurance, or property taxes, call 2-1-1.

- Consumer Finance Protection Bureau (CFPB) – The CFPB provides information to help consumers understand the terms of agreements with financial companies. They also work to make regulations and guidance as clear as possible for providers of financial products and services.

- Freddie Mac Loan Look-Up Tool – A quick, secure way to check if Freddie Mac owns your mortgage.

- Know Your Options – Offers resources on housing education and information, including a search feature to find out if Fannie Mae owns your loan.

- Loan Modification Scam Alert – Highlights common scams homeowners need to be aware of.

- Prevent Loan Scams – Part of the National Mortgage Settlement, this resource helps homeowners understand what counseling and legal resources are available in their state.

- Counseling Services – A housing counselor can assist you through the process of avoiding foreclosure. Counselors offer guidance, but it is a collaborative process where the homeowner plays an equal role.

- Community Action Partnership of NH (CAP): CAP agencies provide a range of services including housing assistance, food, weatherization, child care, energy assistance, and more.

I NEED HELP WITH:

Understanding the Foreclosure Process

Foreclosure is the act of your lender repossessing your home for your failure to fulfill your mortgage obligations. If you do not take steps to prevent foreclosure, you will lose your home.

In New Hampshire the foreclosure sale of your property may happen very quickly. New Hampshire is a power-of-sale foreclosure state. This means that your lender does not need to take you to court in order to foreclose. Instead, your lender will sell your home at a foreclosure sale, using the proceeds of the sale to pay off your loan.

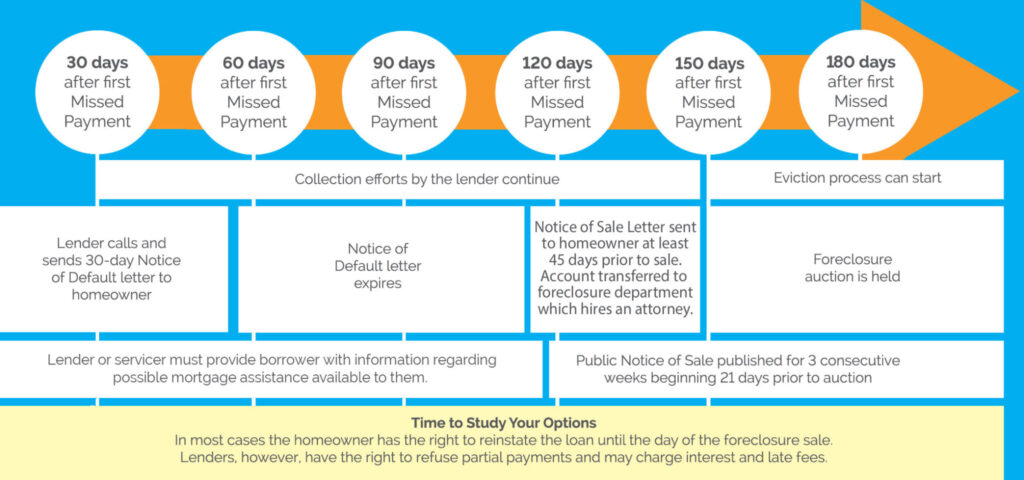

The foreclosure timeline from the homeowner’s perspective

A mortgage is a legal contract between you and your lender. When you are unable to make your payments, you are in breach of that contract and the lender will begin to take actions to recover their investment. Their rights to protect their interests are detailed in the mortgage document. Below is a simple chart outlining an average foreclosure time frame in New Hampshire. You can click on the chart to view a larger printable version.

The foreclosure timeline from a legal perspective

Typically, your lender will send you a letter giving you 30 days to “cure,” which means to bring your loan up to date. If you fail to cure, your lender will accelerate your mortgage obligations, which means that your entire balance becomes due. To complete the foreclosure sale, your lender must take the following steps per NH RSA 479:

- At least 25 days before the scheduled foreclosure sale, the lender must send you a notice of the scheduled foreclosure sale.

- At least 20 days before the scheduled foreclosure sale, the lender must publish a notice of the sale in a newspaper in circulation in your town or county. The notice must be published once a week for three weeks in a row.

- The lender must conduct a foreclosure sale at your home, or another location if specified in your mortgage. The lender can not force you to leave your home on the day of the auction and you do not have to let anyone into your home.

- A third party, or the lender itself, may purchase your home at the foreclosure sale. Once a foreclosure deed is recorded by the new owner, you are no longer the owner of the property and should start considering other housing options.

How to Avoid Foreclosure

Understanding your situation

One of the biggest hurdles to overcome when you are having difficulties with your mortgage is knowing where to start. Below is a list of steps you should consider.

Step 1

If you are behind on your mortgage payments or any other property related expense (i.e. property taxes, insurance, HOA fees, etc), or anticipate that you may not be able to continue making your payments, call a local housing counselor to discuss the best course of action. Housing counseling is a free resource.

Don’t wait! The longer you delay, the fewer options you will have, and the more likely it will be that you will lose your home. Act now!

Step 2

When you talk with a housing counselor, you will need some information ready to begin the discussion. Here’s what you will need to get started.

- Your latest mortgage, property tax, or association statement or payment coupon.

- The mortgage documents you received both before and at the closing of your mortgage loan.

- All correspondence you have received from your mortgage servicer, municipality, or association regarding your payment history.

- Copies of pay stubs for all the income earners in your household.

- Information regarding your monthly household expenses.

Step 3

Be realistic in your expectations.

There are many variables to be considered in each situation, such as whether your financial difficulties are short-term or long-term and how far behind you are in your payments.

Some families who act early and are in a position to accept the terms of any modification agreements reached with their loan servicer can successfully save their home from foreclosure. Unfortunately, the financial situation of some families may not allow them to remain in their home. There may come a time when you need to make some difficult decisions regarding your own situation and whether you can afford to remain in your home.

Avoiding Foreclosure

Contact your lender as soon as you realize you have a problem. If you are worried about making your payment a couple of weeks later than usual, you should immediately let your loan servicer know when you will be making the payment. Make sure the servicer has documented the anticipated date you will be making the payment. Lenders do not want your house. They have options to help borrowers through difficult financial times. If you do not have your servicer’s contact information, contact a housing counselor for free assistance.

Take the following steps if you are unable to make your mortgage payment:

Don’t ignore the problem

The further behind you become, the harder it will be to bring your loan current and the more likely that you will lose your house.

Contact a housing counselor

Housing counselors can help you understand the process and your options, organize your finances and assist you in working with your servicer. Find a housing counselor in your area.

Open and respond to all mail from your servicer

The first notices you receive from your loan servicer will offer good information about foreclosure prevention options that can help you have a positive outcome. Later mail may include important notice of pending legal action. Your failure to open the mail will not be an excuse later in the foreclosure process. Keep every piece sent to you so you can get it to your housing counselor.

Know your mortgage rights

Locate your loan documents and read them to try to get some idea as to what will happen if you are unable to make your house payments. You may want to contact a housing counselor because you could have several options. Do not be afraid to ask what the mortgage loan documents mean. A housing counselor will be able to explain what is in the loan documents, as well as explain the foreclosure time frame in New Hampshire. Be sure to take these loan documents with you when you see your housing counselor. Make certain you understand everything explained to you.

Understand foreclosure prevention options

Your housing counselor has valuable information about foreclosure prevention, including information on loan modification and short sale options. Make certain you understand these options when they are explained to you by your housing counselor. If you do not understand it the first time, do not be afraid to have it explained again. Many of the concepts are difficult to understand.

Save every nickel

If you are behind and the servicer is no longer accepting payments, save as much as you can. You may qualify for assistance if your situation improves and if you are able to contribute funds to “cure” some of the arrearage (missed payments). You may need to hire an attorney or pay for rent if you don’t qualify for any options.

Prioritize your spending

After healthcare, keeping your house should be your first priority. Review your finances and see where you can cut spending in order to make your mortgage payment. Look for optional expenses – cable TV, memberships, entertainment – that you can eliminate. You may want to delay payments on credit cards and other “unsecured” debt until you have paid your mortgage. Your housing counselor will help you put together a spending plan. It will be a “crisis spending plan” initially. Once you are able to get some cash together to start paying back your delinquent payments, you and your housing counselor will develop a more stable spending plan together.

Use your assets

Do you have assets – a second car, jewelry, whole life insurance policy – that you can sell for cash to help reinstate your loan? Can anyone in your household get an extra job to bring in additional income? Even if these efforts don’t significantly increase your available cash or your income, they demonstrate you are willing to make sacrifices to keep your home. Your housing counselor will give you more tips on how to tighten your spending.

Avoid scams

You don’t need to pay fees for foreclosure prevention help – use that money to pay the mortgage instead. Many for-profit companies will contact you promising to negotiate with your lender. While these may be legitimate businesses, they may charge you a hefty fee (often two or three months’ worth of mortgage payment). A housing counselor will provide the same information and services for free. New Hampshire law also provides protection to consumers from misleading foreclosure counseling services.

Understand documents before you sign them

If any firm claims they can stop your foreclosure immediately if you sign a document appointing them to act on your behalf, you may well be signing over the title to your property and becoming a renter in your own home! Never sign a legal document without reading and understanding all the terms. If there is any doubt at all, get assistance from a local housing counselor or from a local attorney.

Don’t ignore the problem

The longer you wait to get help, the harder it will be for your housing counselor or your lender to assist you. Losing your home may be the price you pay for thinking something will come along to fix everything. Action is what will make that happen.

Foreclosure Options and Solutions

The loss of your home from a foreclosure will hurt your credit, family, and future ability to purchase a home. When you are facing foreclosure, time is of the essence. If you want to save your home, do not ignore notices from your servicer! Take simple steps such as the following:

- Contact your servicer, municipality, association, or utility provider

- Seek out professional counseling services and/or legal services

- Consider your options carefully

- Consider applying for the Homeowner Assistance Fund Program

- Educate yourself about foreclosure and current consumer protection laws

First and foremost, if you can keep your mortgage current, do so. But if you find you are unable to make your mortgage payments, you might qualify for a loan workout option. Here are some alternatives to foreclosure that a professional home ownership counselor or your lender may discuss with you.

If your problem is temporary:

- Reinstatement – Your lender is always willing to discuss accepting the total amount owed in a lump sum by a specific date. Forbearance may accompany this option.

- Forbearance – Your lender may allow you to reduce or suspend payments for a short period of time and then agree to another option to bring your loan current. A forbearance option is often combined with a reinstatement when you know you will have enough money to bring the account current at a specific time. If you enter into a forbearance agreement, get it in writing from your lender, make certain you understand the agreement, and be sure you can meet your new financial obligations.

- Repayment plan – You may be able to get an agreement to resume making your regular monthly payments, plus a portion of the past due payments each month until you are caught up.

If it appears that your situation is long-term or will permanently affect your ability to bring your account current:

- Loan modification – If you can make payments on your loan, but don’t have enough money to bring your account current or you can’t afford your current payment, some lenders may be willing to change the terms of your mortgage. For example they may:

- Add the missed payments to the existing loan balance.

- Change the interest rate, including making an adjustable rate into a fixed rate.

- Extend the number of years you have to repay.

- Make a partial claim against your mortgage insurer if you have mortgage insurance.

- Short sale (pre-foreclosure sale) – If you cannot afford your mortgage, selling your property prior to the foreclosure sale may be your best option to avoid a foreclosure and keep your equity. Work with your lender to minimize any loan deficiency balances that may be incurred by you as a result of the short sale.

- Bankruptcy – In some circumstances bankruptcy, particularly filing under Chapter 13, may save your home from foreclosure. To consider this option, consult with a lawyer as soon as possible.

- Deed-in-lieu of foreclosure – Use this as a last resort. Your lender may be willing to accept your property in lieu of foreclosure. Giving your home back to the lender will hurt your credit, but avoids a foreclosure.

Leaving Your Home

Sometimes it just is not possible to afford to remain in your home or avoid foreclosure and you will need to leave your home. The financial and emotional upheaval that losing your home creates often leaves families in a daze and wondering what to do next and how to get on with their lives. If you are in need of post-foreclosure or rental counseling and assistance, the information below may help.

- 2-1-1: If you are at risk of foreclosure or are having difficulty paying your rent and utilities, call 2-1-1.

- 603 Legal Aid: If you need assistance with an eviction, contact 603 Legal Aid, which provides free civil legal services to low-income people.

- CAPNH.org: Community Action Partnership (CAP) agencies offer housing, food, weatherization, child care, energy assistance and other services.

- Emergency Broadband Benefit: The Emergency Broadband Benefit is an FCC program to help families and households struggling to afford internet service.

- New Hampshire Judicial Branch: Information on eviction and eviction diversion.

- Granite United Way: Landlord education and incentive program through CDFA and Granite United Way.

Talking to Your Lender

If you are behind on your mortgage payments, or anticipate that you may not be able to continue making your mortgage payments, the first thing you should do is call your loan servicer to explain your situation and ask who the investor is and what options may be available to help you. Here are some suggestions for talking with your lender about the options they may be able to offer you: Note that some investors will not modify mortgage loans, some may only offer short term forbearance or repayment plans.

Before you call:

- Open and read all mail from your servicer.

- The phone number to call to reach your mortgage servicer will be printed on your mortgage statement or on a letter from your servicer. You can also get contact information for most loan servicers from the NH Banking Department.

- Have your loan number available so your lender can look up your account. Your loan number will be on your mortgage statement. Your name must be on the loan to speak with them. You can supply the servicer with an authorization letter that will allow someone else to discuss your loan with them on your behalf.

- Be prepared to answer questions about why you have missed (or expect to miss) mortgage payments. They may ask you to provide this information in the form of a letter often called a “hardship letter.” If you need assistance in writing a hardship letter, contact a housing counselor.

- Know how much your monthly household income and expenses are (a budget worksheet is available here). Your loan servicer may do a financial assessment to determine what type of workout options may be available to you. You may be asked to provide documentation like pay stubs or income tax forms. You may also need to contribute funds toward a loan workout, so you will need to know if you have any savings available. If you do not have any money saved, you may have to explain to your lender how and when you will be able to provide the money.

- Set aside enough time for the call. You may be placed on hold during your call until a service representative is available to speak with you – be patient.

- Have a pen and paper ready so you can take notes. You will need to be ready to write down names, date, time and everything discussed in the phone call.

When you call:

- Write down the date and time of the call, who you talked to and what the loan servicing representative told you.

- If you are not yet late on your payments, a Customer Service Representative may be able to assist you. If you are already late on your mortgage payment (or the Customer Service Representative could not help you), ask to speak with the “Loss Mitigation” department; this is the department that can talk to you about possible workout options.

- Get a phone number for the person you talk to in the Loss Mitigation department so you can call that person back directly.

- Tell the lender about your situation and that you want to work with them to bring (keep) your mortgage current.

- Answer all the lender’s questions honestly, and be prepared to fax or mail any financial documentation they request as soon as possible.

- Ask them what types of workout options are available to you. Get any proposed workout plan sent to you in writing before you agree to it.

- Don’t agree to or sign any workout plan that you cannot afford!

- If you have questions or want a second opinion, contact a housing counselor.

Legal Questions

New Hampshire Housing does not provide legal advice.

Foreclosure, tax deed, and sheriff’s sale are all legal processes that often move very quickly. If you are threatened with any of these actions, it is important to obtain legal help to protect your rights. This is especially important if you think you may have been a victim of a rescue scam; you feel you may have been unfairly taken advantage of by your servicer, municipality, or provider; or must file for bankruptcy because of your financial circumstances.

No matter your financial situation, 603 Legal Aid services may be able to assist you. Call 1-877-399- 9995 (toll free) or apply at www.603legalaid.org.

603 Legal Aid handles intake for these types of services. When you call, 603 Legal Aid will explain the process and your legal options. Their goal is to return all calls within two (2) business days.

603 Legal Aid

15 Green Street

Concord, NH 03301

603-224-3333

(800) 639-5290

Counseling Services

Counseling Services

A housing counselor is someone who can help you through the process of working to save your home from foreclosure. While counselors will do all that they can to assist you, the process is a two-way street with the homeowner as a critical partner in the process. Each must do their part in order to make the process work and to reach a satisfactory resolution.

Here are some of the services that a housing counselor can offer:

Determining a homeowner’s objectives and needs

A housing counselor wants to understand what you are trying to accomplish. The more information you provide to the housing counselor, the easier it will be to assess your situation. Completing a personal profile intake form and a household budget form before you contact a housing counselor will save time in the process.

Determining time constraints

The housing counselor will need to identify any deadlines you face, especially the foreclosure sale date. Call a housing counselor immediately if mail comes regarding foreclosure. If you are not aware of a sale date, your housing counselor can contact your lender.

Establishing reasons for default & preparing a hardship letter

A hardship letter includes your reasons for falling behind on your mortgage payments, how you plan to overcome those difficulties, and what accommodations you may need from the lender in order to become current on the loan. The letter must be in your own words, but a housing counselor can assist you with this process.

Preparing a spending plan and reducing debt

If you put together a spending plan, a housing counselor can help you go over it line by line to identify all debts and any surplus income. Any surplus you have can be used to start bringing your mortgage payment current. If you have a deficit, a housing counselor can help you decide what costs to cut and determine if there are ways your household can increase its income (for example, a family member can get a part time job, or you can sell assets). A housing counselor can also provide suggestions about how to manage other debts, such as credit card debt and student loans, while prioritizing your mortgage.

Making realistic choices and determining options

A housing counselor can help assess if your goals are realistic given your spending plan and how far behind you are on your mortgage payments. They will review all options available to you and answer questions you may have about how to make a decision and move forward. They will also keep you updated as things progress.

Starting paperwork if you choose to try to save your home from foreclosure

A housing counselor will help you submit any paperwork, such as income and expense documentation or bills, that your lender or servicer requires.

Requesting a delay of foreclosure, tax deed, or sheriff’s sale date

A housing counselor will be an advocate for you in getting a delay on the foreclosure, tax deed, or sheriff’s sale date. They will ensure that you receive it in writing and will help keep an eye on the sale process.

Beware of Scams

A foreclosure “rescue” scam could cost you your home. While not all companies that approach you to help save your home are “scam artists,” you need to be very cautious if someone does offer help that sounds too good to be true. Don’t sign anything until you have done your homework first. Call a housing counselor or your lender and ask them about the offer before making a commitment.

Just remember, if something sounds too good to be true, it’s probably a scam!

Scenarios to watch out for

- Unethical consulting services – Some foreclosure rescuers try to pass themselves off as legitimate foreclosure counselors. They may charge you for services you can easily do for yourself, or take steps that actually hurt you. As a result, you receive little or no help in stopping the foreclosure from taking place. Remember, you can talk to a housing counselor for free, who can advise you on the best steps to take when trying to save your home from foreclosure.

- Deals that let you stay in your home – Some foreclosure rescuers will offer to bring your mortgage up to date and let you stay in your home until you can pay them back. The scammer “bails you out” by helping get rid of your house. The way the scammers get rid of your house varies, but each method ends with you surrendering the title to the house on the promise that you can stay on as a renter and buy the house back once things have been “fixed.” The scammer usually sets the rental price at a level that you cannot afford, and then they evict you for failure to pay the rent. In the end, of course, you can’t buy the house back and the scammers get most, if not all, of your equity.

- Bait and switch/fraud – Some foreclosure rescuers will simply lie about what they will do for you. The scammers will tell you that you are signing documents for a new loan that will solve your problems. In reality, you are signing forged documents that will give the scammers ownership of your home. To make matters worse, you will still owe for the mortgage but will no longer have the home.

How do the scammers find you?

A scammer finds homeowners in need of “help” through local public foreclosure notices.

They advertise their service by dropping a card or flier on your doorstep or calling you. They also post ads in public places. You should ignore posters, fliers and especially handwritten notes offering help for your foreclosure.

How do the scammers hook you?

At the first meeting, the scammer builds up your hopes and promises a fresh start. They also make empty promises; for example, they may tell you they will sell the house back to you at some point.

The scammer will recommend that you break off contact with the lender and any counselor that you may have been working with. This is the exact opposite of what you should be doing. If you are in a foreclosure, you need to be in contact with your lender to find out what you can do to fix the problem.

These scams are often perpetrated by people of similar ethnic, racial, religious or age groups as the homeowner.

What to do if you get caught in a foreclosure rescue scam?

The New Hampshire legislature enacted a law, RSA 479-B, designed to protect you from misleading foreclosure consulting services. Companies offering to pay off your mortgage arrears or provide foreclosure consulting services must comply with this law!

In general, a foreclosure consultant shall not enter into any agreement or provide any services on your behalf until you have executed a foreclosure consulting contract. A foreclosure consulting contract must:

- Be written in the same language that you speak;

- Fully disclose the exact nature of the foreclosure consulting services to be provided to you, and the total amount and terms of the foreclosure consultant’s compensation;

- Be dated and signed by you and the foreclosure consultant in front of a notary public or justice of the peace; and,

- Be accompanied by a “notice of cancellation,” which tells you how to cancel the contract.

A foreclosure consultant who is going to take title to your home must also give you a “notice of loss of ownership” which sets out the terms of the transfer in detail and notifies you of your right to cancel the transfer within five business days.

This is a very limited description of the protections offered to you by RSA 479-B. For the full text of the legislation creating RSA 479-B, please follow this link. To understand how this law may affect you and your particular situation, please contact an attorney.

If you receive a scam in the mail, contact the US Postal Inspection Service to report it.

Definitions

Deed-in-Lieu of Foreclosure – This option is a disposition option in which a borrower voluntarily deeds collateral property to the servicer/lender in exchange for a release from all obligations under the mortgage (although borrower may be subject to potential future tax liability due to mortgage debt forgiveness). Though this option results in the borrower losing the property, it is usually preferable to foreclosure because the borrower mitigates the cost and emotional trauma of foreclosure. In most cases, the Insurer/Guarantor requires this option to be used only after all other options have been exhausted.

Informal Repayment Plans – Plans that are usually short term in nature and is established on the borrower’s ability to repay. This program is used mostly when a loan is in early stages of delinquency (30-60 days delinquent) with a repayment term of 90-120 days. This plan can be verbal or written.

Formal Repayment Plans – This is the most widely used program for a loss mitigation work-out. Financial screening is obtained from the borrower and based on their ability to repay the arrearages, a plan to cure the delinquency is established. Counseling usually is offered to the borrower. Formal repayment plans are always written and can have a much longer term than the informal plan. Based on the borrower’s overage at the end of the month, formal plans are usually set up for a payment and 1/4 or a payment and 1/2.

Loan Modifications – A loan modification is a permanent change in one or more of the terms of a borrower’s loan which, if made, allows the loan to be reinstated and results in a payment the borrower can afford. Modifications may include a change in the interest rate, capitalization of the delinquent principal, interest or escrow items, extension of the time available to repay the loan, and/or reamortization of the balance due.

Loan Servicer – Loan servicers are contracted by mortgage lenders and secondary market loan holders to manage the day-to-day payment collection and payment processing of escrowed items such as real estate taxes and homeowners insurance. They are responsible for collecting, monitoring and reporting loan payments.

Loss Mitigation – This is a process to avoid foreclosure in which the lender tries to help a borrower who has been unable to make loan payments and is in danger of defaulting on the mortgage loan.

Mortgage Lender – The lender provides funds for a mortgage. Lenders also manage the credit and financial information review, the property and the loan application. Mortgage lenders often release servicing to another organization (loan servicer) which means that the customer won’t necessarily send their mortgage payments to the company that made or originated the loan.

Partial Claim – Under the partial claim option, a servicer/lender will advance funds on behalf of a borrower in an amount necessary to reinstate a delinquent loan. This amount should not exceed the equivalent of 12 months PITI. The borrower, upon acceptance of the advance will execute a promissory note and subordinate mortgage payable to HUD. Currently these promissory or “partial claim” notes carry no interest and are not due and payable until the borrower either pays off the first mortgage or no longer owns the property. (This option is only available if you have an FHA insured loan.)

PITI – This acronym stands for “Principal, Interest, Taxes and Insurance” and represents the four elements of a monthly mortgage payment. Payments of principal and interest repay the mortgage loan, while the portion that covers taxes and insurances (homeowners and mortgage, if applicable) goes into an escrow account to cover those fees when they are due.

Short Sale / Pre-foreclosure sale / Compromise Sale – These all mean the same thing. This option allows a borrower in default to sell his or her home and use the sale proceeds to satisfy the mortgage debt even if the proceeds are less than the amount owed. This option is appropriate for borrowers whose financial situation requires that they sell their home, but who are unable to sell without the insurer/guarantor relief because the value of the property has declined to less than the amount owed on the mortgage. With a Deficiency Waiver, this option may protect the borrower from all obligations under the mortgage (although borrower may be subject to potential future tax liability due to mortgage debt forgiveness).

Special Forbearance – A special forbearance is a written repayment agreement between a servicer/lender and the borrower which contains a plan to reinstate a loan that is delinquent and must provide the borrower with relief not typically afforded under an information or formal repayment plan. The term of the plan can be four or more months, suspension or reduction of payments for one or more months to allow the borrower to recover from the cause of default, and/or an agreement to allow the borrower to resume making full monthly payments while delaying repayment of the arrearage.

Subprime Loan – Typically, subprime loans are for persons with blemished or limited credit histories. The loans carry a higher rate of interest than prime loans to compensate for increased credit risk.

Source: HUD.gov.

IF YOU ARE A HOMEOWNER IN NEED OF ASSISTANCE

CONTACT

- Your local welfare office

- If you are homeless or at risk for homelessness, contact 2-1-1

- For assistance with an eviction, contact 603 Legal Aid, which provides free civil legal services to low-income people at (800) 639-5290

LINKS TO RESOURCES

- 995Hope

- Money Management International

- AHEAD (support for Grafton, Carroll and Coos Counties)

- 2-1-1

- HUD Housing Counselor

- If you feel you were a victim of a predatory lender, mortgage fraud or a mortgage rescue scam you should contact:

New Hampshire Attorney General | Consumer Protection Hotline: 1-888-468- 4454 - If you feel your servicer violated a state or federal law you may want to file a formal complaint with the NH Banking Department. Note that the department does not regulate every mortgage servicer. Some complaints may be referred to the Consumer Federal Protection Bureau (CFPB) for processing.

New Hampshire Banking Department | Homeowner hotline: 1-800-437-5991

FORECLOSURE COUNSELING WORKSHEETS

Sign up for our email list

Sign up for our email list